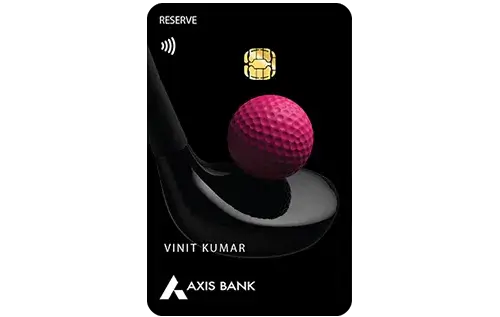

Axis Bank Reserve Credit Card 2025

Unlock up to ₹1,00,000+ value every year on luxury travel, golf, dining & premium memberships!

For high-spenders seeking ultra-premium travel & lifestyle perks, the Axis Bank Reserve Credit Card delivers elite benefits!

Get unlimited lounge access worldwide (domestic/international for primary + add-on, 12 guest visits), 15 EDGE Points per ₹200 (3% on domestic, 6% international up to cap), 50 golf rounds/year, 1.5% forex fee, complimentary memberships (Accor Plus, Club Marriott, EazyDiner Prime), 50,000 welcome points, and waiver on ₹35L spend.

Perfect for frequent flyers & golf enthusiasts – metal card status!

Why This Is The Best Super-Premium Travel Card in 2025?

Unlimited lounges • 3% domestic rewards • 50 golf rounds • Low 1.5% forex • Premium hotel/dining memberships • 50K welcome points • 45 days interest-free • Waiver on ₹35L spend.

Best for: High-income travelers, golfers, luxury lifestyle users, international shoppers

Card At a Glance

₹50,000 + GST

₹50,000 + GST (waived on ₹35L spend)

3% Domestic (Up to 6% Intl)

1.5% + GST

Unlimited Domestic/Intl

50 Rounds/Year

Complete Fees & Charges

| Particulars | Details |

|---|---|

| Joining Fee | ₹50,000 + GST |

| Annual Fee | ₹50,000 + GST (waived on ₹35L annual spend) |

| Welcome Benefit | 50,000 EDGE Points on activation |

| Rewards Redemption Fee | Zero |

| Foreign Currency Markup | 1.5% + GST |

| Interest Rate | 3.6% per month |

| Lounge Access | Unlimited domestic/intl + 12 guest visits/year |

| Cash Advance Limit | 20% of credit limit |

Detailed Reward Rates (2025)

- 15 EDGE Points per ₹200 on domestic spends (3% value)

- 30 EDGE Points per ₹200 on international spends up to ₹1.5L/month (6% value), then 15

- 1 point = ₹0.20 cashback / up to ₹1+ on airmiles (5:4 ratio)

- No points on rent (>₹1L), wallet, gold, fuel, utilities, govt, insurance

- Points valid 3 years; transfer to airlines/hotels (max 1L-4L/year)

- EMI transactions ineligible for points

Airport Lounge Access

- Unlimited complimentary visits to domestic lounges (primary + add-on)

- Unlimited international lounge access via Priority Pass (primary + add-on)

- 12 guest visits/year (domestic & international)

- Valid for departures/arrivals; no spend criteria

Insurance & Protection Benefits

- ₹5 Cr air accident cover + ₹50L emergency overseas hospitalization

- ₹2.5 Cr personal accident cover

- ₹50L transit accident cover

- Zero lost card liability + 3 free add-on cards

Pros & Cons (Real User View)

| Pros | Cons |

|---|---|

| Unlimited global lounge access | High ₹50K fee (steep waiver) |

| 50 golf rounds + premium memberships | Intl rewards capped at ₹1.5L/month |

| Low 1.5% forex + high-value redemptions | No fuel waiver or movie BOGO |

| 50K welcome points (₹10K+ value) | Devaluations in 2024-2025 reduced perks |

| Metal card + concierge service | Hard approval for non-Burgundy users |

Eligibility Criteria & Documents Required

- Age: 18-70 years (salaried/self-employed)

- Min Annual Income: ₹24L (salaried) / ₹30L (self-employed)

- Credit Score: 750+ (Burgundy/Private preferred)

- Documents: PAN, Aadhaar, ITR/Salary slips, Bank statements

How to Apply Online (5-Minute Process)

- Visit Axis Bank website or app (Burgundy login for priority)

- Fill details & check eligibility/pre-approval

- Upload docs + video KYC

- Card delivered in 7-10 days (metal card)

Final Verdict – Should You Get It in 2025?

If you spend ₹25L+ yearly on travel/dining & value golf/lounges, extract ₹75,000–₹1.5L value annually. Top-tier super-premium card post-devaluations – ideal for UHNI with Axis relationship!

Frequently Asked Questions (FAQs)

Is lounge access truly unlimited?

Yes, domestic & international for primary/add-on; 12 guest visits/year.

Fee waiver easy?

On ₹35L annual spend; tough but achievable for high-spenders.

Best redemption value?

Up to 1:1 airmiles/hotels; ₹0.80-1.20/point on transfers.

Golf for beginners?

50 rounds at select courses; lessons/privileges included.